Here’s why big pharma has put down roots in New Jersey

By Hermione Wilson

The Garden State is known for being at the heart of a large concentration of government bodies and business centres, but when it comes to the life sciences, New Jersey has proven to be much more than a middle child to cities like New York, Washington D.C., and Philadelphia. Known as the “medicine chest” of the world, New Jersey is fertile ground for biotechnology and pharmaceutical companies looking to move from proof of concept to production.

New Jersey was the birthplace of healthcare company Johnson & Johnson in 1886 and it has since become a lodestone for big bio business. The state is now home to more than 400 biotechnology companies and 14 of the world’s largest biopharmaceutical companies are headquartered there including Merck, Celgene and oncology research leader Bristol-Myers Squibb.

The state is an ideal location when it comes to the commercialization phase of a company’s development, says Michele Brown, President and CEO of Choose New Jersey. “We know that a company like Radius Health that is in an earlier point in its development has engaged in research opportunities in Boston, and some research opportunities in Pennsylvania, and yet they’re looking hard at the state of New Jersey as they move now into commercialization,” Brown says.

“We have a very long tradition of innovation and drug development,” says Debbie Hart, President and CEO of BioNJ. Because of the state’s rich life science history, there is a large pool of biotech talent companies can tap into, she says. “New Jersey has more scientists and engineers than anywhere else in the world.”

It helps that New Jersey has more than 50 higher education institutions, many of them – like Rutgers University and Princeton – among the highest-ranked schools in the U.S. “All of them are doing cutting-edge research in the life sciences,” Brown says.

Rutgers University in particular has engaged in collaborative agreements with researchers in the private and public sectors around the world. The school is also home to the Institute of Infinite Biologics, the world’s largest university-based cell and DNA repository.

“We’ve done some research on the facilities that are engaged in research in our state devoted to the life sciences and more than a million square-feet of facility space is engaged at this moment in time in research in the biological and health sciences field,” Brown says.

Geographically, New Jersey is particularly well-placed for biotech and pharmaceutical companies. The state is close to important government institutions like the FDA and the National Institutes of Health (NIH) which are just a train ride away in Washington D.C., and Wall Street and the New York Stock Exchange are across the river. Because the state is fairly small, it is simple to “travel the state from one end to the other in a business day and be back in your own bed at night,” Hart says. “You can get from top to bottom in an hour-and-a-half.”

Not only does New Jersey have location and talent going for it, the state has a government that is supportive of life science business and incentive programs that encourage growth in the sector.

“Tufts [Center for the Study of Drug Development] estimates that it takes $2.6 billion to bring a drug to market,” Hart says. Most never make it and it takes 10 to 15 years, so that means generating a lot of cash. It’s a constant challenge for our companies to be out there and raising money.”

Both Brown and Hart gush about New Jersey’s Technology Business Tax Certificate Transfer Program, popularly known as the NOL program, because it allows companies to sell their net operating losses for cash.

“They sell them to a big, profitable company who is a New Jersey taxpayer and that taxpayer can buy them on a discount and apply them on their own tax return and get the savings of that tax payment,” Hart says. “It gives the biotech company an infusion of cash from the sale of their losses and they’re not giving up any ownership, any stock as a result of making that sale.”

It was Hart’s organization, BioNJ, that came up with the idea in the mid-90s as a way of adding value to their losses. It was one of the first programs of its kind, Hart says, and it has gone a long way to encouraging businesses to relocate to the state.

“It allows companies that are working toward commercialization, that haven’t turned a profit yet, to take their accounting losses for the year and sell them to the state government for cash,” Brown says. “It gives non-dilutive financing to these early-stage companies that they can then use as operating revenue.”

The NOL program transaction can bring in anywhere from a couple $100,000 to $7 million, the largest incentive awarded to date, Hart says. That comes to about $60 million a year, Brown says. Another incentive program the New Jersey state government offers, the Angel Investor Tax Credit program, generates $10 million a year and gives investors tax credit against their state income taxes equal to 10 per cent of an investment they make in an early-stage life science or biotech company, Brown says.

Both she and Hart credit the NOL incentive program as Celgene’s saving grace. In 1998, the biopharma company, which has been headquartered in New Jersey since the 1980s, had “35 employees and six weeks of cash, but some pretty promising technology,” Hart says.

The company took advantage of the NOL program and managed to make a comeback by bringing back the drug thalidomide, notorious for causing catastrophic birth defects in the 1960s, and achieving FDA approval. Celgene went back to the drawing board with thalidomide and discovered that the compound was effective in treating blood cancers. “It was sort of the founding drug approval for the company,” Hart says.

Today Celgene has more than 7,000 employees worldwide and operations in about 60 countries, as well as key research facilities throughout the U.S. and in Spain.

“We have 50 unique compounds, the majority of them having different mechanisms and actions that are addressing unmet medical needs in close to 100 indications in the area of cancer and immunoinflammatory type diseases,” says Brian Gill, Vice President of Corporate Affairs.

Not only is New Jersey an ideal place for companies looking to move toward commercialization, with its incentive programs and ready workforce, it is a welcoming place for early-stage companies as well.

The state government funds several co-working locations across the state in urban areas where there is a lot of start-up activity, and the state-owned Commercialization Center for Innovative Technologies (CCIT) provides biotech start-ups with the facilities and the technical support they need to grow their business.

“When a small company moves into our centre, they get not only below-market rent, but they also get technical expert assistance by executives in residence that can help them through their projects as the move toward commercialization,” Brown says. Her company, Choose New Jersey, also holds Founders and Funders events to put those companies in contact with payers and venture capitalists.

“Everything is happening in New Jersey,” Gill says. “New Jersey represents the epicentre of the world when it comes to life sciences and is well represented in medical centres, in academia, as well as medical innovators like Celgene that are helping to change the course of human health.”

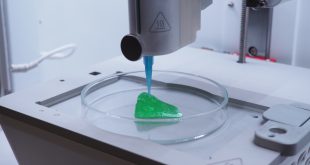

Hard at work at Rutgers University’s RUCDR Infinite Biologics in New Brunswick (top right), New Jersey (bottom right), and Ferring Pharmaceuticals’ facilities in Bridgewater, New Jersey (middle). Photo Credit: Choose New Jersey

The state is now home to more than 400 biotechnology companies and 14 of the world’s largest biopharmaceutical companies.

The foyer of Celgene Corporation’s headquarters in Summit, New Jersey. Photo Credit: Celgene

Not only does New Jersey have location and talent going for it, the state has a government that is supportive of life science business and incentive programs that encourage growth in the sector.

New Jersey Facts

400+ biotech companies

14 of the 20 world’s largest biopharmaceutical companies

$87 billion economic output linked to the biopharmaceutical sector

3,100 life science establishments

More than 50% of 2015 new FDA drug approvals came from companies with a NJ footprint

70,991 jobs in the biopharmaceutical sector, and an additional 251,058 jobs indirectly linked to the industry

22,000 life sciences graduates annually from 63 colleges and universities, including 13 teaching hospitals and 3 medical schools

BioLab Business Magazine Together, we reach farther into the Canadian Science community

BioLab Business Magazine Together, we reach farther into the Canadian Science community