Thailand’s capital city is at the centre of the country’s life sciences progress

By Hermione Wilson

Thailand wants to become a vital part of the global value chain, says Panit Kitsubun, Director of the National Biopharmaceutical Facility (NBF). Almost two years removed from a military coup and contending with a floundering economy, the kingdom’s life sciences sector is treading water and looking to the future. The key to that future is Thailand’s capital city of Bangkok, home to the country’s highest concentration of hospitals, research institutions and biotech companies.

“All the larger scale healthcare facilities and hospitals are in Bangkok,” Kitsubun says. “I believe we have the second or third-highest number of JCI (Joint Commission International) certified hospitals in Asia just behind China, although China is much larger than us.”

One of the largest hospitals in Bangkok is also the country’s first. Established in 1888 by King Chulalongkorn (whose father was famously portrayed in The King and I), Siriraj Hospital is managed by Mahidol University and serves as a teaching hospital for its medical school. “It has now become one of the biggest hospitals in Asia in terms of numbers of beds and patient enrolment,” says Nares Damrongchai, CEO of the Thailand Center of Excellence for Life Sciences (TCELS), an arm of the Thai government whose mission is to support the growth of the nation’s life science industry.

With its cluster of world-class private hospitals, Bangkok has become a hub for medical tourism, Damrongchai explains. Patients come from the U.S., Europe, Australia, The Middle East, and a large majority from Japan, he says. Needless to say, the focus of Bangkok’s life sciences sector tends to centre on medical services, as well as the manufacture of pharmaceuticals and medical devices.

A combination of highly trained clinicians and a large population means that Thailand’s capital also happens to be a great place for doing late stage clinical trials, not to mention much cheaper when compared to the U.S. or Europe. In the last couple of years the sector has made an effort to transition from late stage to early stage clinical trials, Kitsubun says. “We have invested in facilities throughout the country,” he says. The Medical Research Network of the Consortium of Thai Medical Schools, or MedResNet, coordinates all medical schools and clinical trial sites in the country.

“In Thailand… most of the R&D is carried out in public research institutions and academia,” Kitsubun says. “We do have a number of biopharmaceutical and vaccine companies here, but of course they are more focused on the manufacturing part.”

Kitsubun’s company, NBF, is a public institution that was established to serve as Thailand’s first CGMP-compliant (Drug Applications and Current Good Manufacturing Practice) contract manufacturing organization for the production of biopharmaceuticals for phase I and II clinical trials. The facility was jointly developed by KMUTT University and the National Center for Genetic Engineering and Biotechnology (BIOTEC).

“We cater to both the research and development part of the story,” Kitsubun says. “We help scientists, whether they are in academia or in public research institutions, or startup companies, or pharmaceutical companies, we help them go into clinical trials.” NBF also uses its facilities to develop human resources for the industry. It runs a graduate program called Biopharmaceutical Engineering Practice School which trains 10 students a year in the inner workings of a biopharmaceutical pilot plant. Students attend lectures for two semesters, spend one semester in the work-integrated learning program, and in their final semester conduct an independent research thesis in biopharmaceutical R&D.

All of this is an effort to harness Thailand’s strengths in research and manufacturing, and translate it into commercialized products for export overseas. The government has been concentrating on making Thailand self-sufficient, says Vitoon Vonghangool, President of privately owned vaccine manufacturer BioNet-Asia. “But for privately owned companies, we have to think about our own self-sufficiency. That means we have to sell small and export more, at least within Asia. You have to think about export, because the domestic [market] is too small.”

Vonghangool explains that, despite Bangkok’s many prominent research universities, like Mahidol, Chulalongkorn, Chiang Mai, and Khon Kaen, most institutions operate only small-scale lab research and don’t have much translational research they can develop in a pilot plant. “They don’t have that capacity yet, because that involves a lot of funding and experimentation,” Vonghangool says, speaking specifically to vaccine development. “Making vaccines, you need a minimum of 10 to 15 years.”

Part of the reason the government is more inclined to fund smaller scale research projects is that they tend to publish studies faster. Thai universities publish 300 to 400 studies per year, Vonghangool says, but when it comes to development, they struggle to sustain funding.

BioNet-Asia is one of the few Thai vaccine companies that handles every part of the process, but it didn’t start off that way. “We started as a consulting company,” Vonghangool says. “We had the knowledge in terms of marketing, the market, and connections with vaccine makers all over the world.” Vonghangool worked for Sanofi Pasteur for 22 years before leaving in 1992 to set up his own company. “We started with a bit of trading and diversified to manufacturing in 2007,” he says. “Today we cover the full range of the vaccine supply chain, from trading, domestic, international and also manufacturing.”

About 90 years ago Thailand was one of the first countries in southeast Asia to produce vaccines, Kitsubun says. “The thing is, in the past 20 or 30 years, Thailand has missed opportunities in investing in newer technologies.” Still, Thailand is catching up fast in the biotech space, he says. After years of buying and selling vaccines, BioNet-Asia will soon launch a product of its own, a vaccine for whooping cough. Meanwhile, Bangkok company Siam Bioscience is making inroads into the biosimilars space.

“Siam Bioscience is in the process of registering its G-CSF at the Thai FDA,” Kitsubun says. “I believe they are trying to crack the EU market as well, and they are also looking into monoclonal antibodies.” G-CSF is a growth factor used to increase white blood cells after cancer treatment. Kitsubun says biosimilars like this would greatly reduce the costs of pharmaceuticals in the country.

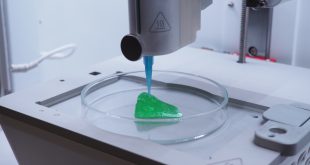

Thailand Science Park in northern Bangkok is home to a cluster of research institutes and companies from a variety of industries, including cosmetic companies like Shiseido, food companies, as well as pharmaceuticals and biotechs. TCELS is planning to build a facility there that would provide startups with leased R&D space, as well as special facilities for cell production. Construction is expected to start later this year and companies are already lining up to move in, Damrongchai says. The incubator will be called the GMP Facility for Cell and Gene Therapy Products.

“We really have strong R&D and vaccine companies, and supporting systems like university R&D,” he says. “Everybody is in Bangkok.”

What’s needed to push the Bangkok life sciences sector – and Thailand’s life sciences by extension – to the next level is a strong commitment of support from the government, Kitsubun says. “We need to build up an ecosystem,” he says. “What we have now is a scattered picture of many pieces of manufacturing capabilities and researchers, but these are not very well connected still. We need to have a better understanding of how we can link all the actions and all the efforts and commercialize those research results as well.”

Also missing is the involvement of private investors, Kitsubun says. Most Thai investors are focused on tech and engineering startups, but when it comes to biotech, he says, they don’t understand that the development stage takes much longer than in other industries. In biotech you many have to wait 10 to 15 years before you see a commercialized product, but the returns at the end of the day are high. That’s something Kitsubun says venture capitalists from overseas seem to have a better grasp of and many have come to Thailand to shop around.

Because of that, it is key to the further growth of Thailand’s life sciences sector that Bangkok becomes a welcoming place for foreign investors and VCs. To that end, the Thai government has begun to offer new policies like an eight-year tax break for foreign companies. The government is also discussing whether to offer exemptions from personal income tax and a streamlined visa and work permit application service for expats who come to work in Thailand.

“That’s not enough,” Vonghangool says. “In the life sciences you may need 10 to 15 years to have success, but before that, how will the government support you?”

Damrongchai and his colleagues at TCELS, along with consortium of Thai pharmaceutical companies, have been working together on a policy package for the government that will improve the investment incentives for multinational biopharmaceutical companies looking to come to Thailand. The policy package includes things like a multi-year tender policy, extending the period of tax breaks, and importing equipment tax-free, and is expected to be adopted in the next few months, Damrongchai says.

Damrongchai is optimistic about the future of Thailand’s life science sector. “The quality of the medical service here, which attracts customers from all over the world, the world-class universities, the number of JCI institutes… I look at this as really good infrastructure, which attracts investment, attracts people and technology.”

Photo credit for image named 8_RegionalProfile2.jpg: TCELS is an arm of the Thai government charged with supporting the growth of the life science sector.

Photo credit for image named 8_RegionalProfile3.jpg: Dr. Nares Damrongchai (bottom), CEO at TCELS, speaks at an event in Seoul, South Korea.

Sidebar

Thailand Facts and Figures

» Bloomberg Markets magazine ranked Thailand third among its Top 20 Emerging Markets in 2013 behind South Korea and China.

» Thailand’s export of pharmaceutical products has seen a growth of 6.12 per cent over the past five years.

» National Biopharmaceutical Facility (NBF) is Thailand’s first CMO for manufacturing of biopharmaceuticals for phase I/II clinical trials.

» BioNet-Asia is the only vaccine company in Thailand that is 100 per cent privately owned.

» Thailand has more than 1,000 public hospitals and more than 300 private hospitals.

» Thailand is a hub of medical tourism with 2.35 million foreign patients receiving treatment in 2014.

» Siriraj Hospital in Bangkok was founded more than 120 years ago by King Chulalongkorn.

» The Thai government spends 14 per cent of its total budget on the healthcare industry, which accounts for 4.6 per cent of the country’s GDP.

Photo credit for image 8_RegionalProfile sidebar.jpg: BioNet-Asia vaccine plant facilities.

BioLab Business Magazine Together, we reach farther into the Canadian Science community

BioLab Business Magazine Together, we reach farther into the Canadian Science community